The impact of the COVID prism on your clients

When turning to a business adviser, clients surely seek some certainty in their sage advice - and for this they seek positivity about the problems faced today will not be there for ever. Those problems may not get solved but the individual and the business has to find a parallel universe that they can traverse into.

The polarising effect 2020, applied to your business client portfolios, means that there are some clients in your firm who are feeling fit as a fiddle and others who are disheartened and tired.

While not the exit of dreams; restructuring a business, winding down cost effectively or selling off assets can be a positive experience. This lifts the stress of uncertainty and being able to take a step forward is an essential phase of repairing the damage done.

For the others sensing an opportunity, they will be seeking advice to help them be assertive and acquisitive.

For both sides the ability to raise, recover and protect capital has never been more important.

Defining your segmentation

In reality, between these two sides of this balance sheet spectrum there are many more sub-groups. Understanding these groups is essential to business advisory.

For example, taking the two businesses before the pandemic - let’s say a digital marketing agency who both had retail clients. One happened to have concentration in bricks and mortar clients - think Paperchase - and the other happened to focus on ecommerce-enabled brands - think Kingfisher.

Optically, before COVID both could be judged by their numbers, yet now their business models are fundamentally different. As is their segmentation in your portfolio when it comes to their balance sheets.

Q2 2021: Another beam splitter event

What’s more - in 2021 there is a second “portfolio splitting” event approaching. HMRC liabilities with VAT deferrals, CBILS/Bounce Back loan repayments and tightening cash flow with furlough stopping offer a real threat to businesses in Q2 2021.

Accounting firms must ensure they have the best advisory tools set-up in their practice before the end of March 2021 to be able to support their clients.

Data and segmentation of clients using cloud accounting data is never more important to be able to spot risks in portfolios or react swiftly to client requests. These requests are almost certainly going to be around the balance sheet of the business.

The growing demand for business advisory

After an economic event as seismic as COVID the market is typically extremely dynamic - opportunities arise, market share becomes available for grabs and consolidation is inevitable.

This “COVID lens” means some clients are looking for growth or looking to buy other businesses while others are thinking now is a good time to throw the towel in. As an adviser's responsibility to be there from company incorporation to the exit this is a crucial time.

All your segments are going to need advice and likely have transactional work. While this means you’re going to be busy there is an opportunity to use partnerships to help alleviate capacity constraints in your practice.

The below table highlights the top five client support services UK firms are prioritising this year.

|

Service line

|

% Responses

|

|

Cash flow and management

|

67%

|

|

Business recovery and restructuring

|

33%

|

|

Raising finance

|

26%

|

|

R&D claims

|

24%

|

|

Grants

|

20%

|

Source 2021 Capitalise mulitple choice survey

Business advisory needs data and workflow

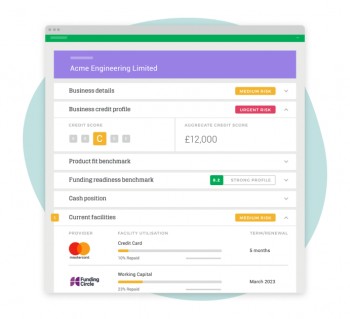

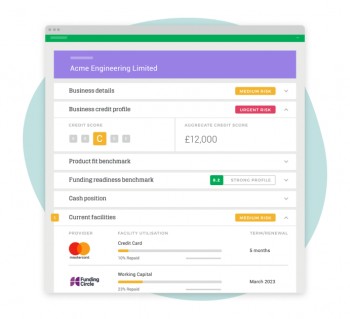

Data allows you to segment your client base. So identifying how and where you can segment your clients for your portfolio in 2021 is a top priority.

Data allows you to segment your client base. So identifying how and where you can segment your clients for your portfolio in 2021 is a top priority.

This is unlikely to be a single solution but will certainly involve connecting your cloud clients to Apps such as Capitalise.com or Clarity.

Capital advisory is a critical components to any business advisory service.

Future proofing the accounting industry

Continuing this idea of business advisory beyond the pandemic, we brought together a panel of industry professionals, hosted by TED speaker and founder of the Business Development Academy, Rob Brown, to discuss what future-proofing the accounting industry means to them.

Rob Brown was joined on the panel by Paul Barnes from MAP, Zoe Lacey-Cooper from Accountex, Emma Chesson from Kreston Reeves and Matt Flanagan from Appacus.

United Kingdom

United Kingdom  South Africa

South Africa

Data allows you to segment your client base. So identifying how and where you can segment your clients for your portfolio in 2021 is a top priority.

Data allows you to segment your client base. So identifying how and where you can segment your clients for your portfolio in 2021 is a top priority.