You can easily check for County Court Judgments (CCJs) against any company with a Capitalise for Business account. Simply sign up for free to see if there are any CCJs or other legal notices registered against your business.

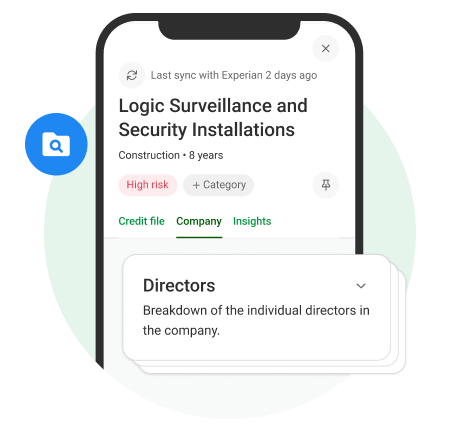

With an upgraded plan, you can also access the credit profiles of the companies you work with. This allows you to see if any of your business partners have a CCJ registered.

Whether you invoice other companies or operate within a supply chain, this step is essential to assess potential risks and make smart, informed decisions about who you do business with.

Wouldn’t it be better to know in advance how likely a business is to pay you on time and honor their commitments, before you start working together?

When working with other businesses, you can't predict whether they'll pay you on time, leaving your cash flow vulnerable to potential risks.

Checking if a company has any legal notices, like CCJs, can give you valuable insight into their financial stability.

Stay ahead of potential risks and ensure your business remains financially secure with a free CCJ check. Sign up today to:

By staying informed, you can make smart decisions and safeguard your business cash flow.

Spot risks early and boost your balance sheet with better funding

A good place to start understanding your company credit profile.

Recommended

Recommended

Your full credit profile plus 10 company credit checks.

Your full credit profile plus 100 credit checks.Ideal for finance and compliance teams looking for a risk management tool.

Easily see if any legal notices, like CCJs, are registered against your business

Easily see if any legal notices, like CCJs, are registered against your business

Get detailed information about any registered CCJs, including the court and case number

Get detailed information about any registered CCJs, including the court and case number

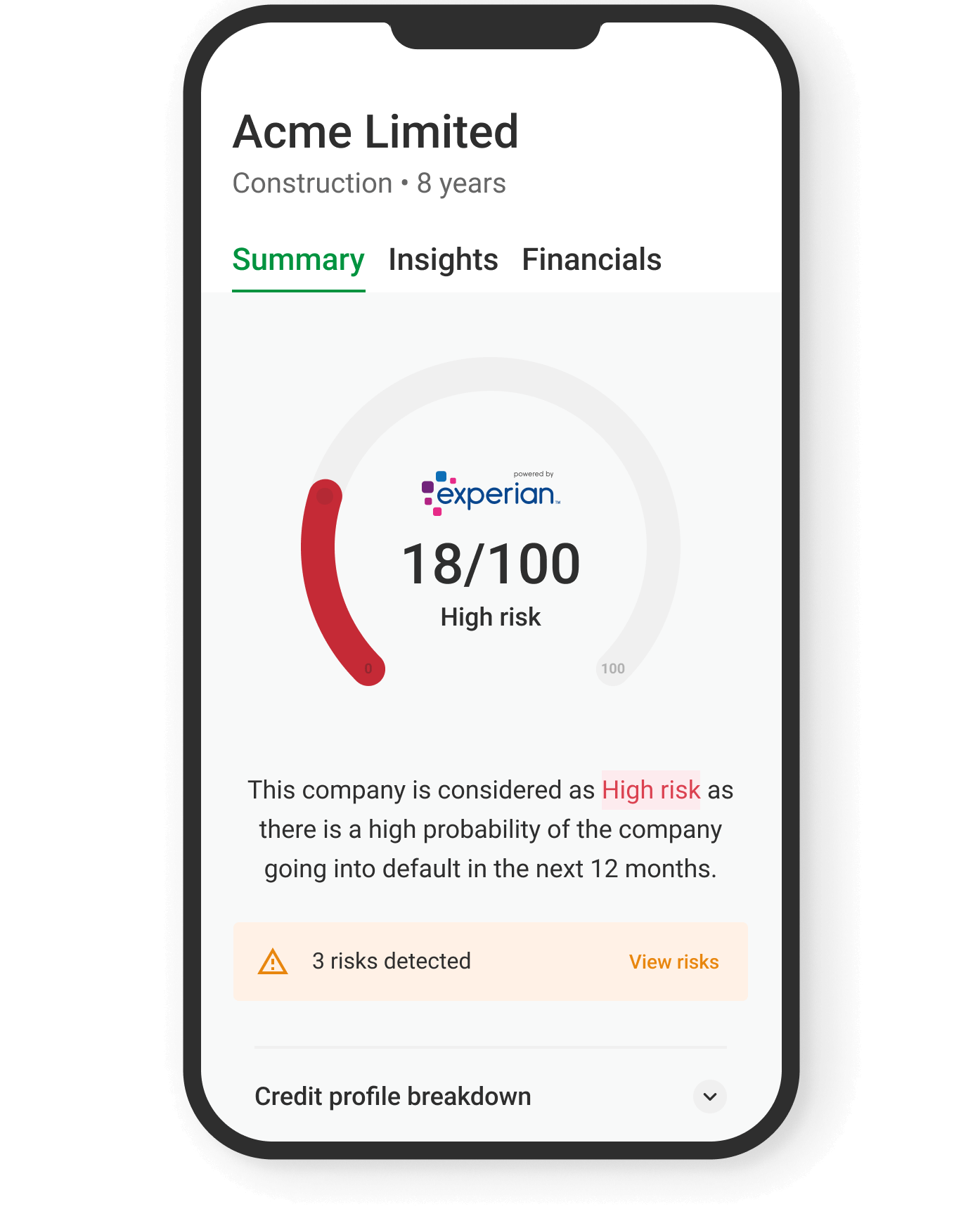

View your business credit score, credit limit, and other key financial details

View your business credit score, credit limit, and other key financial details

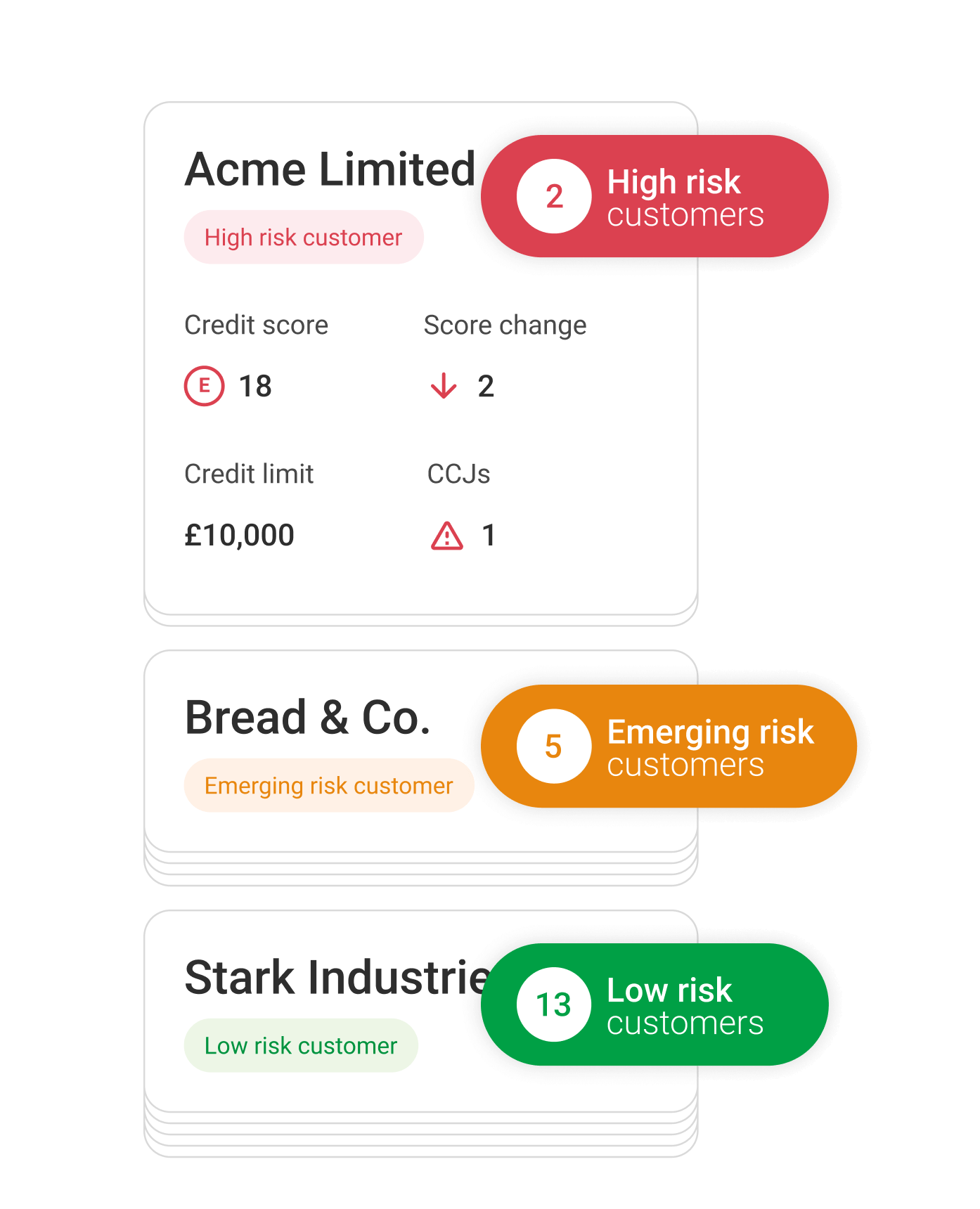

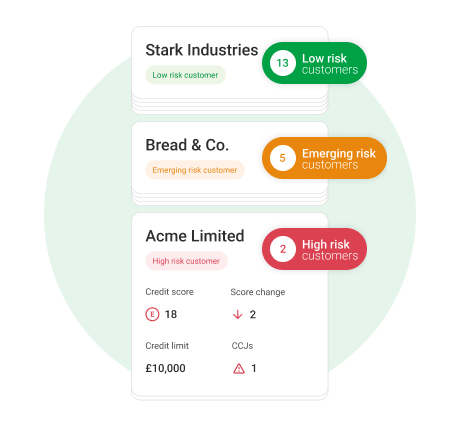

Check for CCJs or other legal notices against the businesses you work with to avoid supply chain disruptions

Check for CCJs or other legal notices against the businesses you work with to avoid supply chain disruptions

Use suggested credit limits to make smarter decisions about the credit terms you offer

Use suggested credit limits to make smarter decisions about the credit terms you offer

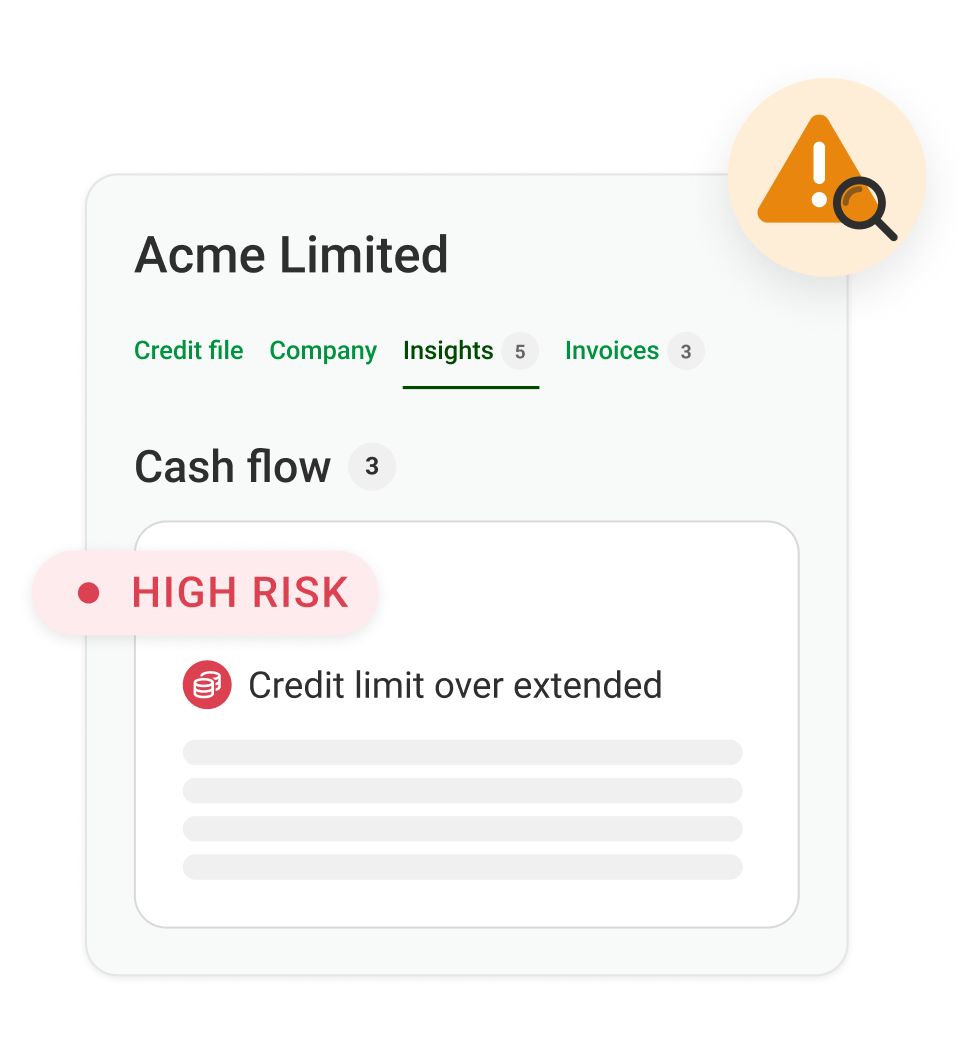

Review credit scores, payment history, and any legal notices to assess if you’re likely to be paid on time

Review credit scores, payment history, and any legal notices to assess if you’re likely to be paid on time

Get instant alerts whenever there are changes to your customers' credit profiles

Get instant alerts whenever there are changes to your customers' credit profiles

Take quick action to prevent late payments - follow up on overdue invoices and adjust credit terms as needed

Take quick action to prevent late payments - follow up on overdue invoices and adjust credit terms as needed

Be alerted as soon as a CCJ is registered against your business, giving you 30 days to resolve it before it impacts your credit for 6 years

Be alerted as soon as a CCJ is registered against your business, giving you 30 days to resolve it before it impacts your credit for 6 years

Download detailed company credit reports as PDFs to keep on file

Download detailed company credit reports as PDFs to keep on file

Use these reports to make well-informed decisions about potential business partners and credit terms

Use these reports to make well-informed decisions about potential business partners and credit terms

Having a CCJ against your company means that a court has ruled that your business owes a debt, and you failed to pay it by the due date. This can harm your company's credit rating and may make it harder to get business loans or credit in the future. It may also affect your company's reputation with suppliers and clients.

All details of any judgments registered against a business will be on the Registry of Judgments, Orders and Fines. To view the register, you have to pay a small fee - each search costs between £6 and £10.

Credit bureaus like Experian also list any CCJs against a company in their credit reports. With a Capitalise for Business account, you can perform a free CCJ check on your own business and view your basic credit profile. If you upgrade to one of our paid plans, you’ll be able to check for CCJs on other companies as well.

Yes, CCJ details are public. They are recorded in the Registry of Judgments, Orders and Fines as well as on business credit profiles. They can be accessed by anyone, including creditors, lenders and partners. This information is often used by credit bureaus to assess a company's creditworthiness.

No, County Court Judgments (CCJs) are not listed directly on Companies House. However, they can show up in public records. You can check for CCJs easily through your Capitalise account.

A CCJ registered against a Ltd company typically does not directly affect the director or their personal credit score. However, it can have an indirect impact.

In some cases, directors may be personally liable for the company’s debts, especially if they've signed a personal guarantee. This means that while the CCJ affects the company, in rare cases, directors could face personal financial consequences if the company fails to pay the debt.

Yes, a CCJ can be removed if it is paid in full within 30 days of the judgment date. This is called a 'satisfaction' of the CCJ. After it's marked as satisfied, you can apply to have the CCJ removed from your company's credit report. If the CCJ is paid after one month, it will still remain on the business’ credit profile for six years, even though it is marked as satisfied.

Failing to pay a CCJ can have serious consequences. It will stay on your business credit profile for six years, severely damaging your business credit score. This will make it difficult to get a business loan, access credit from suppliers and attract new business partners.

If the debt remains unpaid, creditors may also pursue additional legal measures to recover the amount owed. This could include enforcement actions.

It’s important to address a CCJ as soon as possible to avoid these financial and legal repercussions.

If you're working with a company that has a registered CCJ, it could be a sign of financial difficulties. It's important to assess the potential risks to your business, such as:

In these cases, it may be wise to reconsider extending credit, follow up on overdue invoices, or even reassess your business relationship to avoid potential financial risks.

You can view the case number and the court where the CCJ is registered through your Capitalise account. With these details, you can contact the court directly to request information on the claimant who made the case against your company.