There’s been a lot to chew and swallow when it comes to navigating through these bumpy and unpredictable economic times. From ‘mini budgets’ causing instability to inflation spikes, being an accountant and business adviser has never been more challenging. But as always, accountants are constantly stepping up.

Yet, it’s no secret that there's been a talent and capacity shortage in the accounting profession.

That’s why we’ve just launched something big. To help you maintain and scale your firm and offer a standout client experience.All through an add-on service that doesn’t add strain to your firm or your team.

‘Client Tools’ - a new service for your firm

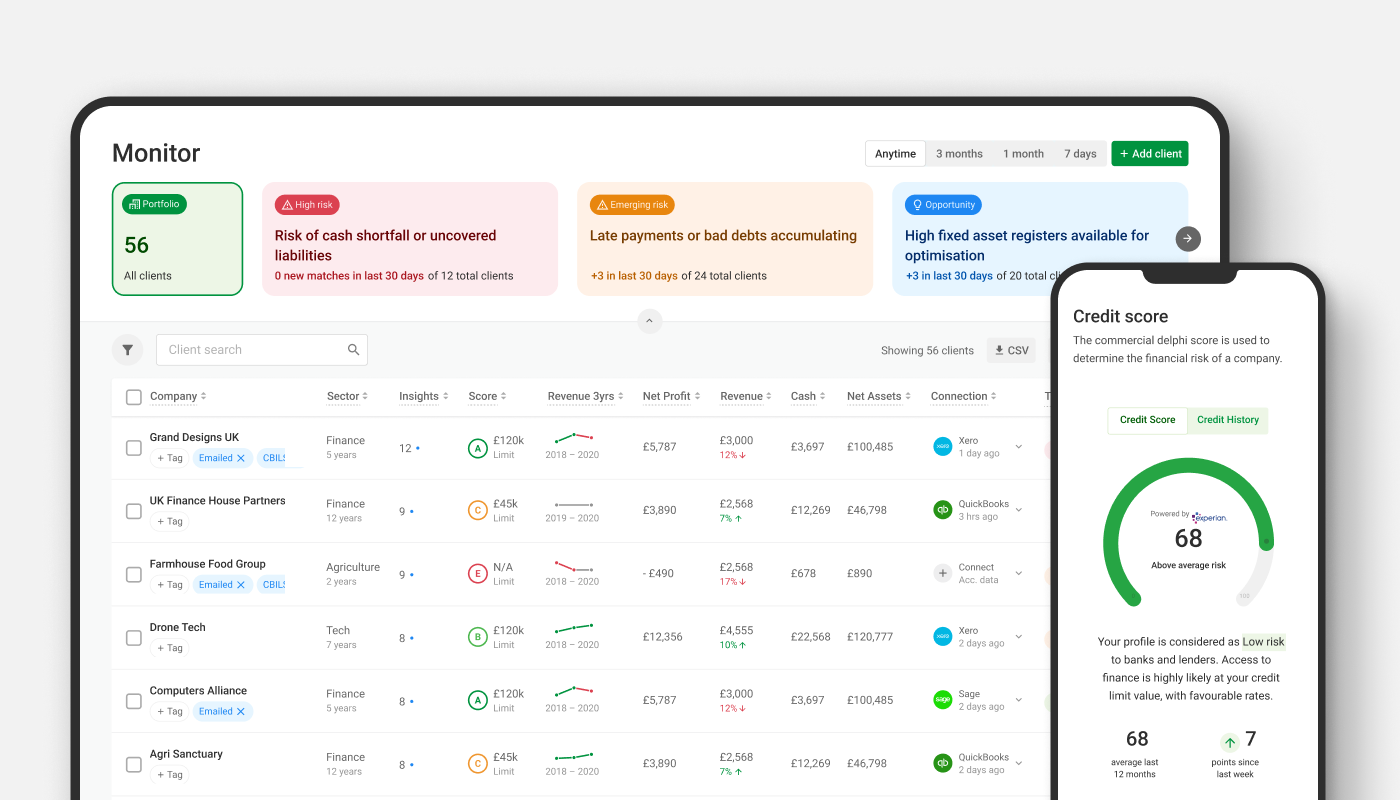

‘Client tools’ is our brand new feature that helps you supercharge your firm’s services by offering your clients access to their credit profile, in a completely self-service format.

Through the platform, they’ll be able to view their Experian business credit score, credit risks, access to funding with over 100+ lenders and much more including our Credit Review Service.

By signing up, your clients will be able to:

- Access their full Experian business credit profile (a free version and a paid version)

- Monitor risks of their debtors and suppliers up to 100 companies

- Find funding from a panel of 100+ lenders (with your team notified)

- Submit information to have their credit score professionally reviewed by Experian

All introduced by you.

These add-on services help activate your clients into your firm's service, amplifying your advisory relationship and helping your firm stand out from the crowd.

Discover your new client experience

Going beyond the basics and offering new business advisory services - has never been easier. And in this unpredictable macroeconomic environment, it has never been more important.

Here’s the benefits to your firm of implementing ‘client tools’:

1. Give a little extra to your smaller or non-advisory clients

We know every client is different and your business clients look to you for all different types of relationships - some purely compliance, some more advisory.

If not all clients want a full advisory service, you may not see the benefit of spending large amounts of time and resources on widening your services, skills and workforce. That’s when Capitalise ‘client tools’ can be a great add-on.

We provide the platform for you, that does the work for you. So you have the time to offer the extra services when requested, without the admin or cost - helping you retain your full portfolio.

2. Offer a valuable service to clients without having to find the extra manpower

Client tools is a simple service which doesn’t need to involve your whole team. You can select who uses the platform and how many clients you introduce.

You won’t need to hire extra staff to offer more services, and the platform can help you and your existing staff supercharge their client relationships in every meeting.

Alongside this, you and your team will get notified when your clients want more support. This means it’s easier to be up to date and get ahead of client needs. And you will feel more at ease and confident with your advisory skills.

3. Get extra insight into your clients with full Experian data

Client tools is powered by Experian data, giving both you and your clients insights from one of the UKs leading credit bureaus. This means you’ll be able to see exactly what lenders and stakeholders see when judging your clients business and their affordability.

This data insight will give your firm the edge from other accountancy firms. To help you stand out from the crowd and win new clients.

4. Add a new revenue stream

This new product feature gives you and your firm new tools, creates new conversations and offers your firm a new unique value. You have more to offer your clients and better insights to help them reach their business goals.

We have different commercial models that help you use ‘client tools’ to boost your firm’s revenue. You can choose between a revenue share or a discount to your client.

To find out more?

Advisory made simple and effective

Going beyond the basics for your clients can be a challenge. With fewer staff and less time on your hands, offering additional services could feel like a stretch you don’t have to give. Yet, with the current macroeconomic picture, small businesses urgently need more support. And now it’s never been easier and more accessible.

With ‘client tools’ you have the insights right at your fingertips, and we’ll help you every step of the way.

Sign up for your account here and get insights into 10 of your clients for free

United Kingdom

United Kingdom  South Africa

South Africa