When clients are talking to you about their challenges, it’s very likely cashflow is up there. They may mention difficulties with making payments on time, their ability to hire new staff or a frustration with current credit terms. This can be a great time to open up the cashflow conversation and remind your clients of ways they can improve their cashflow understanding or position.

Very often, opening up the cashflow conversation highlights a crucial need for funding to keep business running smoothly, or growth projects take off. At Capitalise, we’ve found small business leaders rely heavily on their accountants for this funding and business planning advice. And can be slow to identify the need, without their financial adviser helping them.

We want to help you better spot the need for funding, and access the solutions your clients need to say yes more often to their next business move.

Opening up the funding conversation

On average, we’ve frequently found that businesses would apply for funding just seven days before they needed it. Leaving a panicked dash for cash when employees, suppliers or overheads need paying.

Being in control of the numbers is a key part of your value as an advisor, but asking the right meaningful questions really sets you apart. Dive deep into how your clients are feeling about their current business health as well as their future plans. This can keep you in the loop with everything going on in their world. Which can help you identify the needs for funding as you predict what is needed to bring their plans to life.

Getting to grips with this early, can help you plan with them the resources they need to keep plans moving forward.

Top tip: Make funding an agenda point in every meeting

Key questions to ask:

- What are your main business goals this year?

- Tell me about the level of business advice you need right now?

- Do you feel your future plans could benefit from some investment?

- Where could we help when it comes to funding for the future?

Have a full funding network at your fingertips

With an increased need for funding on many small businesses, clients will be looking to you more than ever to help them source investment. In-fact, recent research showed that although small businesses account for around 98.5% of all businesses in South Africa, they historically have struggled to access funding to grow.

In a 2018 survey, only 6% of small businesses were able to secure government funding and just 9% in the private sector. At Capitalise, we’ve carefully built up our South African funding marketplace to help you find the most suitable funding, loans and finance facilities for your clients.

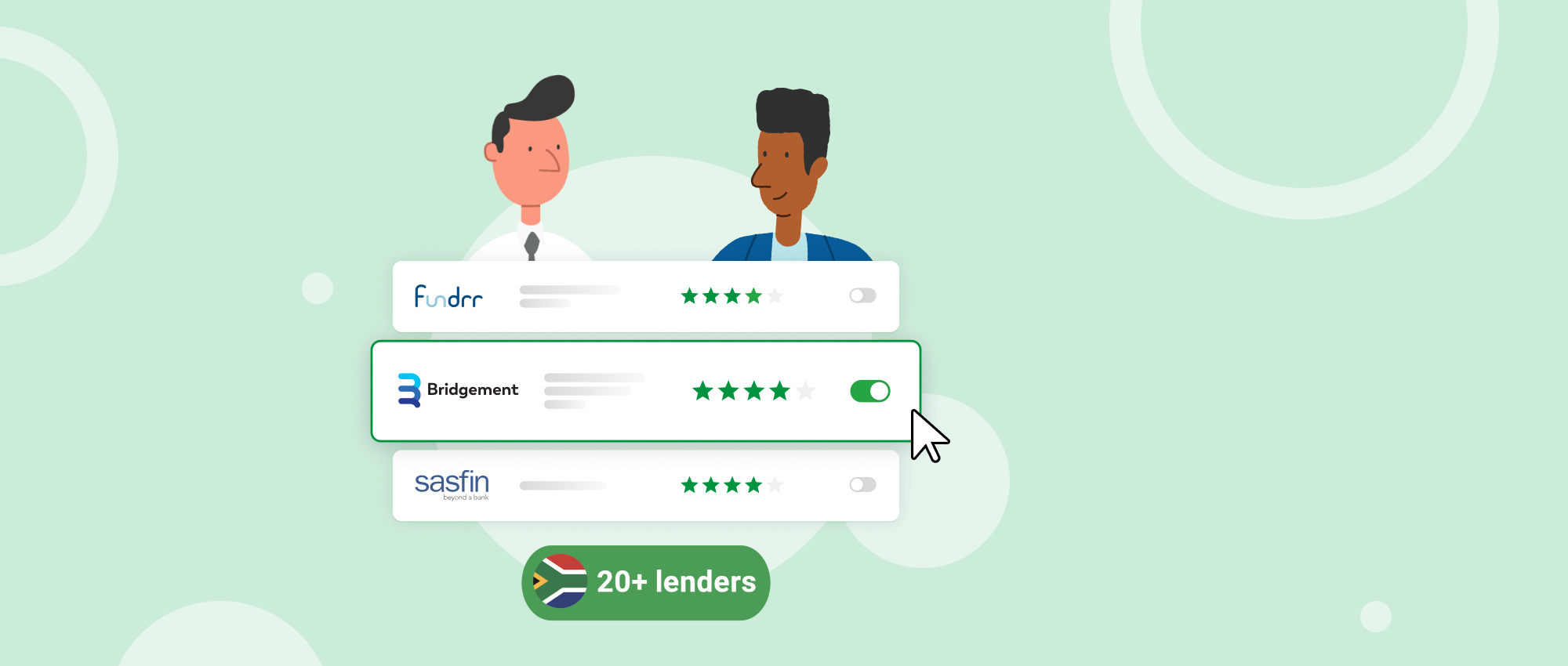

With our carefully selected and curated lending marketplace, you can connect your clients easily and quickly to lenders that really match their business needs.

We have a South African funding marketplace to find the most suitable funding, loans and finance facilities from our carefully selected and curated lending marketplace.

Best yet, you can get started all for free!

Top tip: Use our marketplace to offer a variety of different funding solutions that truly meet the needs of each client.

Access funding and improve your client relationships

As your clients go-to adviser, help them understand that their cashflow is the beating heart of their business. And that funding can help them keep their cashflow healthy. By better understanding the challenges they face and using our marketplace to solve these, you’ll never be better placed to help promote your clients business growth.

Win-win; funding for your clients, and a competitive edge for your firm. Get your clients funding fit, build stronger relationships and win new clients.

Click here and sign up to Capitalise for free to get started.