In 2004 the threshold for audits increased from companies with a turnover of £1m to £5.6m. Prior to this date, most qualified accountants trained in audit. Assuming most of these audit trainees were aged mid-20s at the time, those same individuals, if still in practice, are likely to be in senior leadership positions.

Further rises since that date have brought us to the current situation where most small companies are now exempt and therefore typically we only see audits where the company has turnover in excess of £10.2m. As a consequence, most audit firms have seen their audit assignments fall dramatically, some of whom decided to end their audit registration altogether. Regional practices now focus much more on bookkeeping, accounting and advisory services.

Released from the audit restrictions of independence and objectivity these advisers can now use their long-standing skills to have a huge influence on their clients’ business operations, growth and profitability.

The newer firms of accountants in the profession are relishing that opportunity and are actively measuring the impact they are having. However, do some more traditional firms still struggle to forget the shackles of their audit training? Is the transition of culture from auditor to adviser smooth across the whole practice?

This blog runs through potential ideas on how those auditors in your firm could move beyond the trained auditors’ natural inclination to only observe and analyse with all their clients, but to give more when the client is no longer an audit.

What more could you be giving to clients?

- Get 360 view of your clients cashflow

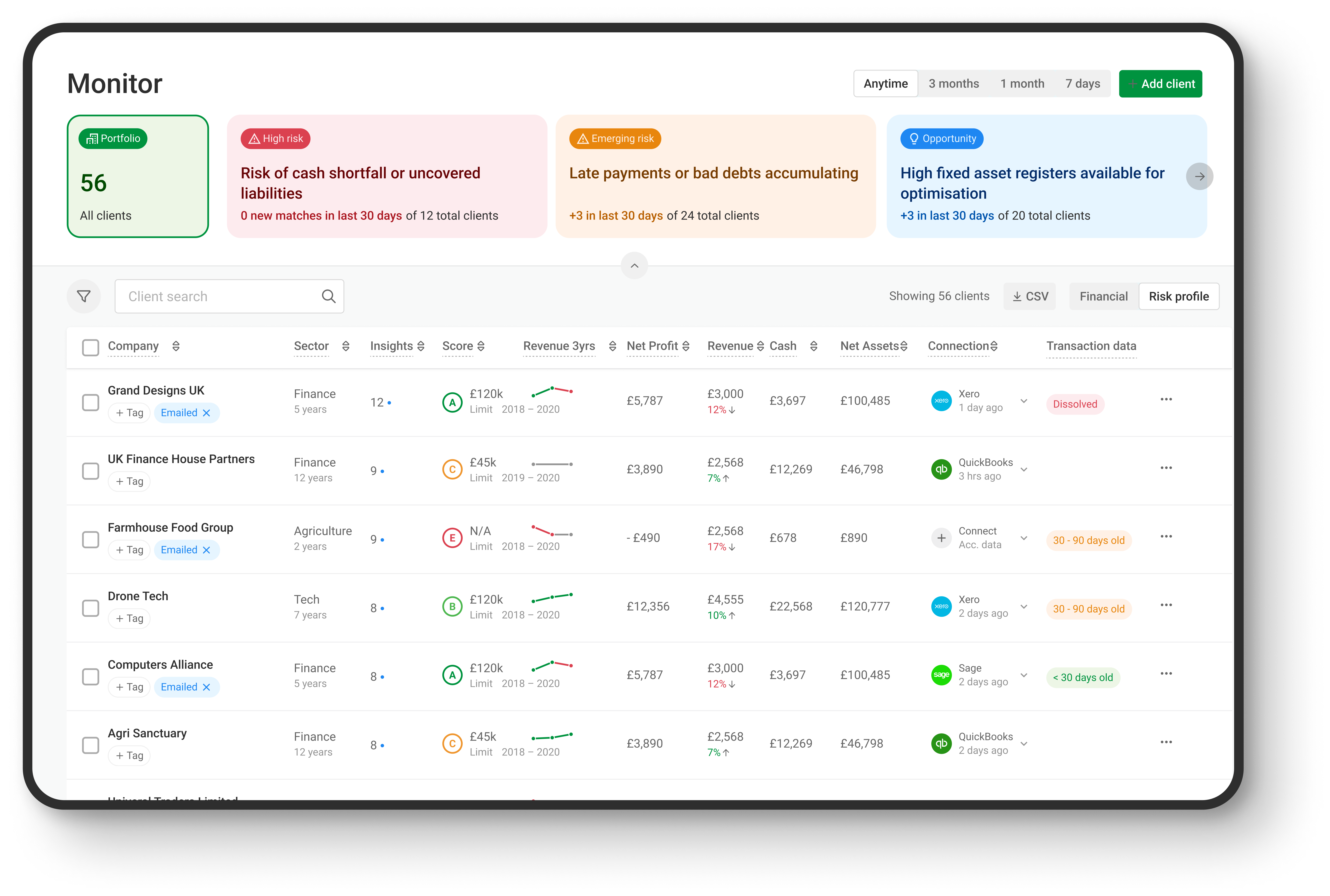

Capitalise for Accountants provides access to the Monitor dashboard, which includes public data from Companies House and Experian.

Monitor gives you a series of insights that surface other potential conversations which can then be discussed in your client meetings. These include where the platform has identified a future potential working capital gap, adverse impact on credit scores or opportunities such as eligibility for funding, and many more.

If the business uses cloud accounting, further insights are available, such as where bad debts are accumulating.