The number of new small accountancy firms and bookkeepers in the UK has boomed since 2018 despite there being fewer qualified accountants joining the industry than since 2016.

In fact, their research shows that there’s been a 40% increase in small practices and bookkeepers – increasing from around 55,000 to nearly 77,000 – between 2018 and 2023. Whilst most of these employ less than 4 people, some of the newer firms founded over the past 10-20 years are beginning to take client market share and also attract employees.

This blog talks you through how to support your firm to differentiate yourself from the wider market and remain appealing to both new clients and new recruits.

Winning in a tough recruitment market

According to the FRC Key Facts and Trends 2022 report, the number of student and qualified members joining established industry bodies like ICAEW and ACCA is in decline. The number of registered audit firms also continues to decrease, from 5,127 in 2019 to 4,745 in 2021.

The market for talent was already difficult for mid-size firms, facing competition from the largest firms in the country. However now, these newer, smaller firms, who are less likely to be auditors, are also able to attract high calibre staff, due to the perception that they carry out exciting work for their clients together with increased job satisfaction.

Many firms have chosen to create whole websites to attract new team members. GreenStones in Peterborough, has careers pages on its main website like most practices, but they also use this domain to focus directly on how potential employees would benefit from joining the firm. They include news items specifically relevant for team members, recommended reading lists and details of their accreditations and awards.

Kinder Pocock, established in 2005, uses its careers pages to demonstrate the cloud and digital solutions they specialise in, stating they are “known as pacesetters in the digital accounting world”. The cloud pages also list the software they work with, including Capitalise. A video from the founder explaining the hiring process brings an additional personal touch.

Client services with a different focus

Newer firms of accountants, that have partnered with Capitalise, tend to describe their services in a different way:

- MAP, founded in 2013, discusses “financial maturity” to appeal to the digital agency sector, its specialist target clients. Phrases such as “Understand your Agency's financial maturity and identify opportunities to optimise performance” and “The size and ambition of your agency will determine the MAP Methodology™ components and the team that you’ll need to achieve your goals” highlight key words which demonstrate their understanding of that particular sector.

- MDH founded in 2009, leads with “Clarity for business owners to inspire decisive action. What do we want? Happy clients”. Quite a different approach to many traditional firms, they continue to focus on the business owner, rather than their services “What we’re about can be summed up in just a few words: we’re all about you...about you having a goal and a vision that we can help you drive forward as you move towards a better business, and in doing so, have the opportunity to go for the personal success you want.”

- Consilium founded in 2013 states “We are an entrepreneurial firm that focuses on providing advice, wise counsel and outstanding business planning to our clients. Our name is drawn from the Latin consulō which means to plan, to advise and to counsel. Consilium’s vision is to help clients and our team realise their goals.”

- Flinder founded in 2017, also targeting a niche sector in high growth, tech, SaaS and ecommerce businesses focused on the value of their processes “Smart finance functions® and data analytics. Flinder replaces your accountant, in-house finance team and data consultants to build and run your finance function and improve reporting.”

Each firm highlights the reason a client should choose them, describing the benefits of working with the firm, rather than the list of technical services the firm offers or the length of time the practice has been established.

Using Capitalise to attract new team members and clients

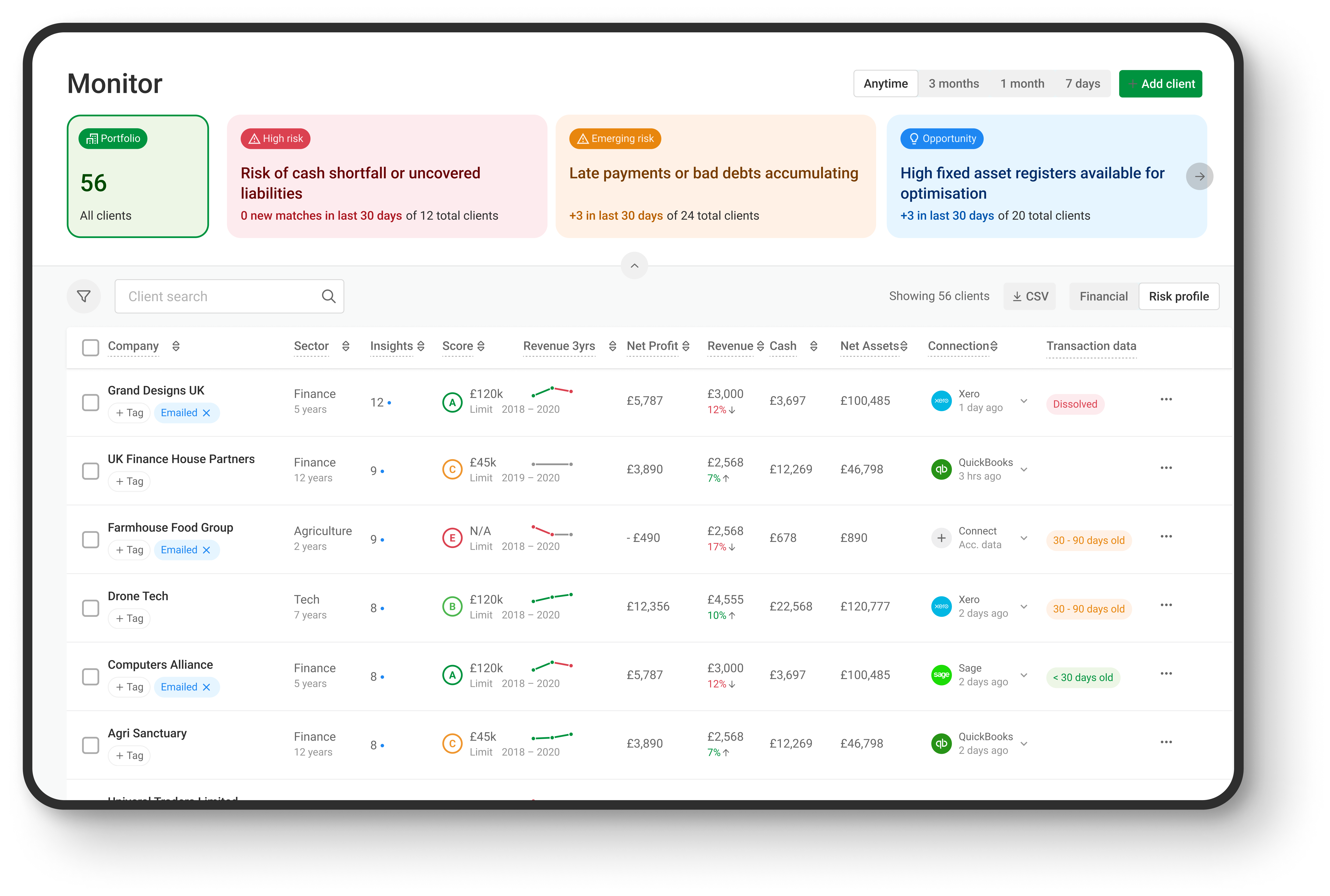

Capitalise for Accountants provides additional insights for your portfolio from publicly available sources such as Companies House and Experian, enabling you to have more powerful conversations with your clients.

This may identify specific risks or opportunities which lead to discussions around how to strengthen their balance sheet, such as identifying a need for external funding, debt recovery or credit score improvement.

Team members are supported with coaching and training from Capitalise so they understand the technical solutions, but also have the confidence to approach the conversation with their client in the best way.