Thincats

ThinCats is a leading alternative finance provider dedicated to funding growing and ambitious mid-sized SMEs.

Filling the gap created by the banks’ inability to service much of the commercial finance market, ThinCats specialises in secured loans from £1m up to £15m for working capital, growth finance - including acquisitions and refinancing. Cash flow lending is a particular area of expertise for supporting businesses in sectors that do not typically own significant amounts of physical assets.

Thincats products & sectors

When you have a relationship with ThinCats, you are working with people who care about your business's success. We take the time to listen, to gain a close understanding of your business strategy, your challenges and opportunities. Then, we respond with a bespoke funding solution designed to help you realise your ambitions.

Key criteria

- MSEs domiciled in the UK

- Loans from £1m to £15m

- 6 month to 5 years, amortising or bullet

- Security required

These working capital loans can be used to support almost any area of your business. Whether you need funds to expand your premises, purchase new assets or grow your workforce, financing starts from £1m and can run for a maximum of five years.

Thincats key benefits

ThinCats are committed to combining innovative data analysis techniques with a human touch in order to accurately assess the merits of each application they receive. Due to this methodology they have received the highly coveted 5-star rating from the independent financial product rating agency, Defaqto.

Their unique use of sponsors means that you'll have a financial expert working side by side with your business every step of the way, whilst preliminary assessments will help to determine eligibility from outset. The entire process has been designed with speed and accuracy in mind with a view to providing capital to businesses within weeks rather than months.

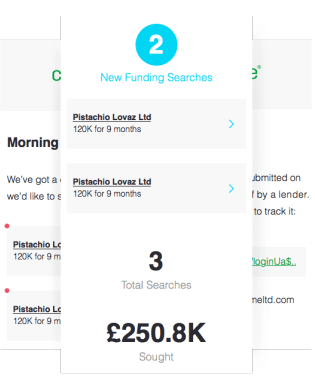

Compare ThinCats and other lenders instantly

Compare ThinCats with our ever-growing panel of expert SME lenders by creating your business profile at Capitalise.com today. We'll help you to discover lenders with a proven track record assisting similar businesses within your sector whilst allowing you to make multiple, simultaneous applications from one central hub.