Fear and Loathing

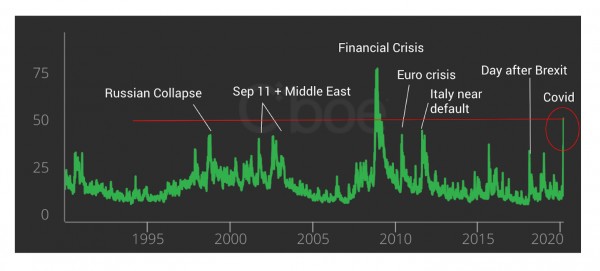

In a former life, the Volatility Index (VIX) had a big impact on my day to day. Illustrated below, the VIX was created by the Chicago Board of Options Exchange (CBOE) to represent the market’s expectation of 30-day forward-looking volatility. It is also known as the "Fear Index".

As you can see - going back to 1990, there has only been one period, the financial crisis where the market was pricing in more market volatility than today. Greater even than the Russian debt crisis, September 11 and the Middle East aftermath, the issues in Europe, (Greece, Italy etc) and even puts into perspective what the World thought of Brexit’s impact on the global economy.

However - whilst we should all take note of the severity of this move - I would like to draw your attention to how quickly these spikes in volatility normalise. Each of the events listed above were clearly significant on a global basis, but the fear that came with them diminished. We have been through many meaningful crises over the last 30years, but we do always get through them and we will again.

Economically we will see a global coordinated slowdown. On rocky ground already - 2019 registered a 2.9% GDP measure, barely above 2.5%, widely regarded as signalling a global recession. Despite significant stimulus already in place, a global recession as a consequence of Covid-19 is likely to be Chinese led, with Italy leading the way in Europe. The UK will have to manage this along with Brexit, Trade talks will inevitably be delayed.

For the Northern hemisphere, this is a seasonal virus and as such its severity will relent as we move into the summer. So what might feel like draconian measures from governments to restrict travel, events etc feels like the right tactic to slow the onset, enabling mother nature (summer) to take back some control.

Whilst short term the outlook is poor, Governments and central banks are responding. We have seen the BoE take action with the specific intent to create the biggest impact along with the budget.

Whilst the direction of travel is set, the size of the challenge for the BoE is still unclear. In cutting rates to all-time lows (0.25%) the bank is reducing costs and improving the availability of funds through the monetary system. Outside of monetary transmission via the banks, the BoE has limited ability to directly support SMEs.

The Government, however, has many tools available. Via the budget scrapping business rates for shops and cafes, providing access to businesses interruption loans, refunding sick pay for sub 250 employee firms are good first steps.

The Government is able to borrow at the cheapest levels in its history and it benefits from having some of the longest duration debt (average 15yrs) in Western economies which despite rhetoric in the press about the high debt to GDP ratio - it means its own funding is more secure than the other countries. My sincere hope is that if required they will use this to create the greatest leverage for SMEs during this period by going much further - such as breaks on Payroll taxes, National insurance, longer payment terms on corporate tax & VAT bills, all of which will impact our accounting community greatly and benefit our SMEs, the backbone of our economy.

I believe that the seasonality of the virus helped by mother nature and the onset of summer, the rapid response from the BoE and the Government will support our economy in the medium to longer term.

Banks Response

In the near term, we are seeing encouraging signs from the banks relative to historic crises.

For existing bank borrowers, the messaging from our Tier 1 lenders has been positive - Lloyds, Natwest and Barclays seem to be open to overdraft increases, extensions and repayment holidays. Natwest, for instance, have committed a £5b fund, whilst Lloyds have arranged £2b of fee finance available for SMEs up to £25m.

Valuations may be a little slower, underwriters may take a little extra time as they undertake additional diligence. Outside of the obvious sectors, travel, retail, hospitality - the lenders are open for business, if not a little more cautious.

If your SMEs need capital or through supply chain issues might in the future, I would be mindful that the lenders might not always be as open as they are today and look to engage the market for solutions.

Capital as a force for good

We believe in Capital as a force for good - Our vision is a future of more sustainable businesses supported by experts, built on strong balance sheets.

As I reflect on that now - Cashflow and balance sheets are going to be strained in the months ahead, but through expert guidance (you) and access to the market (Capitalise), we will do our best to support the engine of our economy and return to the status quo.

If you have any questions and would like to talk about the matter further you can reach me at Paul@Capitalise.com.