All you need to know about CBILS in one place. Our Cheat Sheet explores benefits, eligibility criteria, and the required documentation to apply.

We use cookies to give you the best online experience. For more information review our cookie policy.

Coronavirus Business Interruption Loan Scheme (CBILS) process is new to us all. These templates will make it easier for you complete applications and give lenders a good insight into the affordability of your clients.

CBILS is a programme run by the British Business Bank to support businesses who can afford lending products but lack the security necessary to be approved.

Whilst we're all learning the process as we go along, we are sharing the templates that will make it easier for you complete CBILS applications

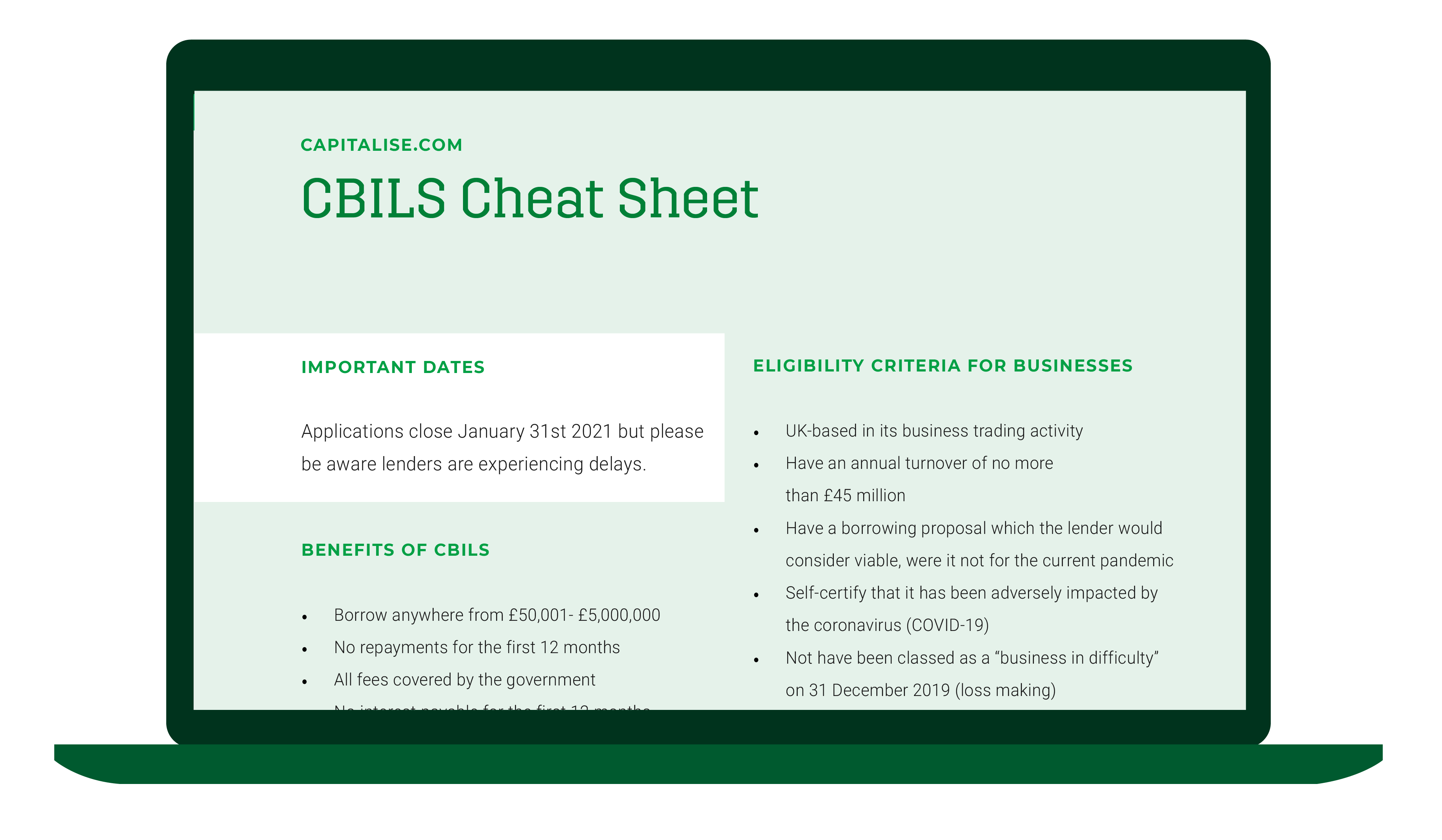

All you need to know about CBILS in one place. Our Cheat Sheet explores benefits, eligibility criteria, and the required documentation to apply.

Not sure where to start with CBILS? There's a lot of information flying about so we've put all you need to know (the basics) in one neat place.

This CBILS Cheat Sheet breaks down the benefits, eligibility criteria, minimum required documentation to apply and more.

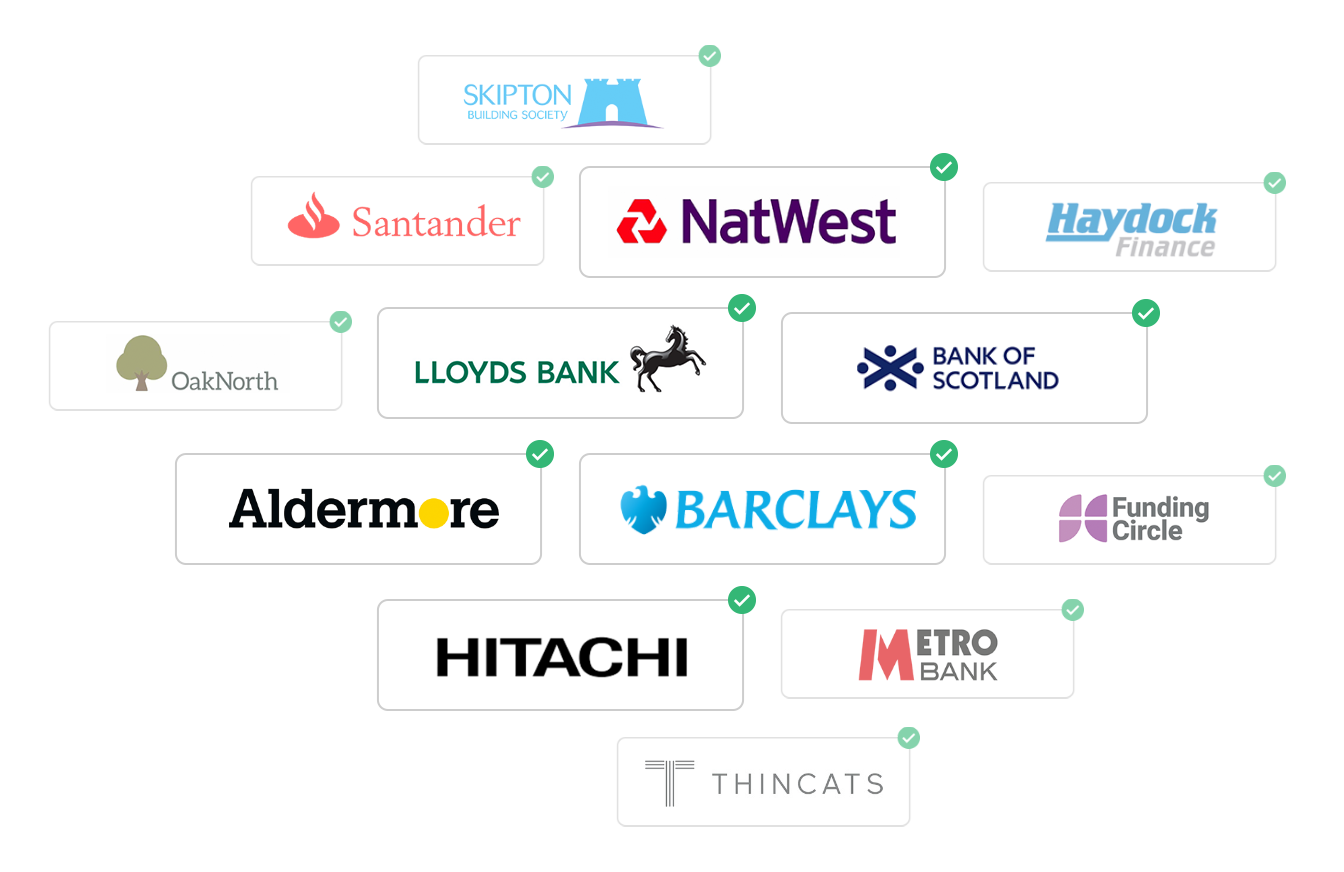

Capitalise has 33 of these 90+ lenders on our platform and our matching service will identify which products a business is eligible for. Don't hesitate to get in contact with us for more information on the CBILS process.

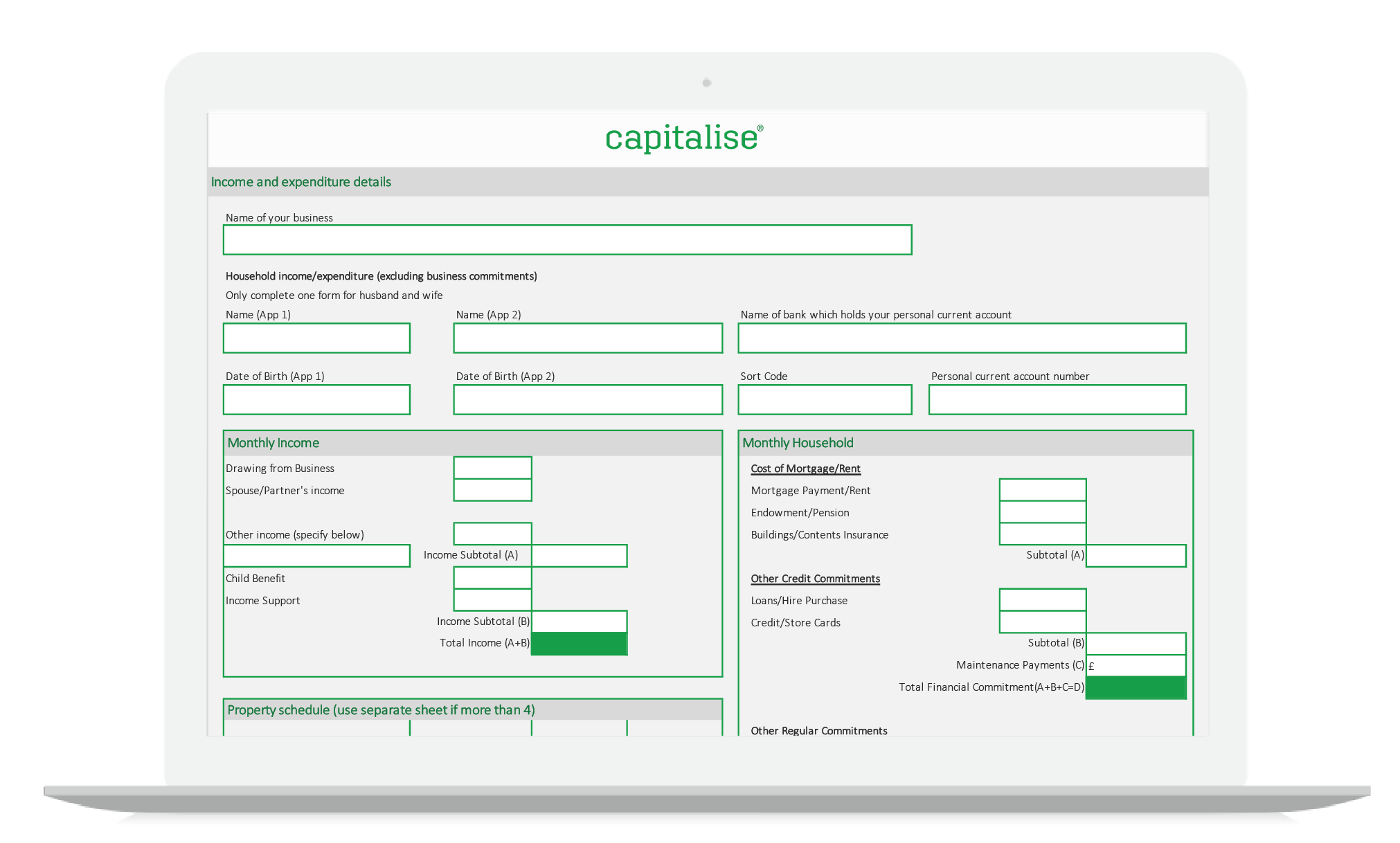

When applying for CBILS, Lenders require Personal Assets Liabilities Income Expenditure (ALIE) for all company Directors. Use our template to help.

The CBILS application process requires a personal ALIE for all directors and shareholders of the business. There are two main reasons for this.

Firstly, it's needed to support any Personal Guarantee, which may be required for debt over £250k.

Secondly, it allows lenders to assess the drawings required by the Shareholders - this helps lenders ascertain the maximum retained profit (post dividends) in a business to service new debt.

Capitalise has 33 of these 90+ lenders on our platform and our matching service will identify which products a business is eligible for. Don't hesitate to get in contact with us for more information on the CBILS process.

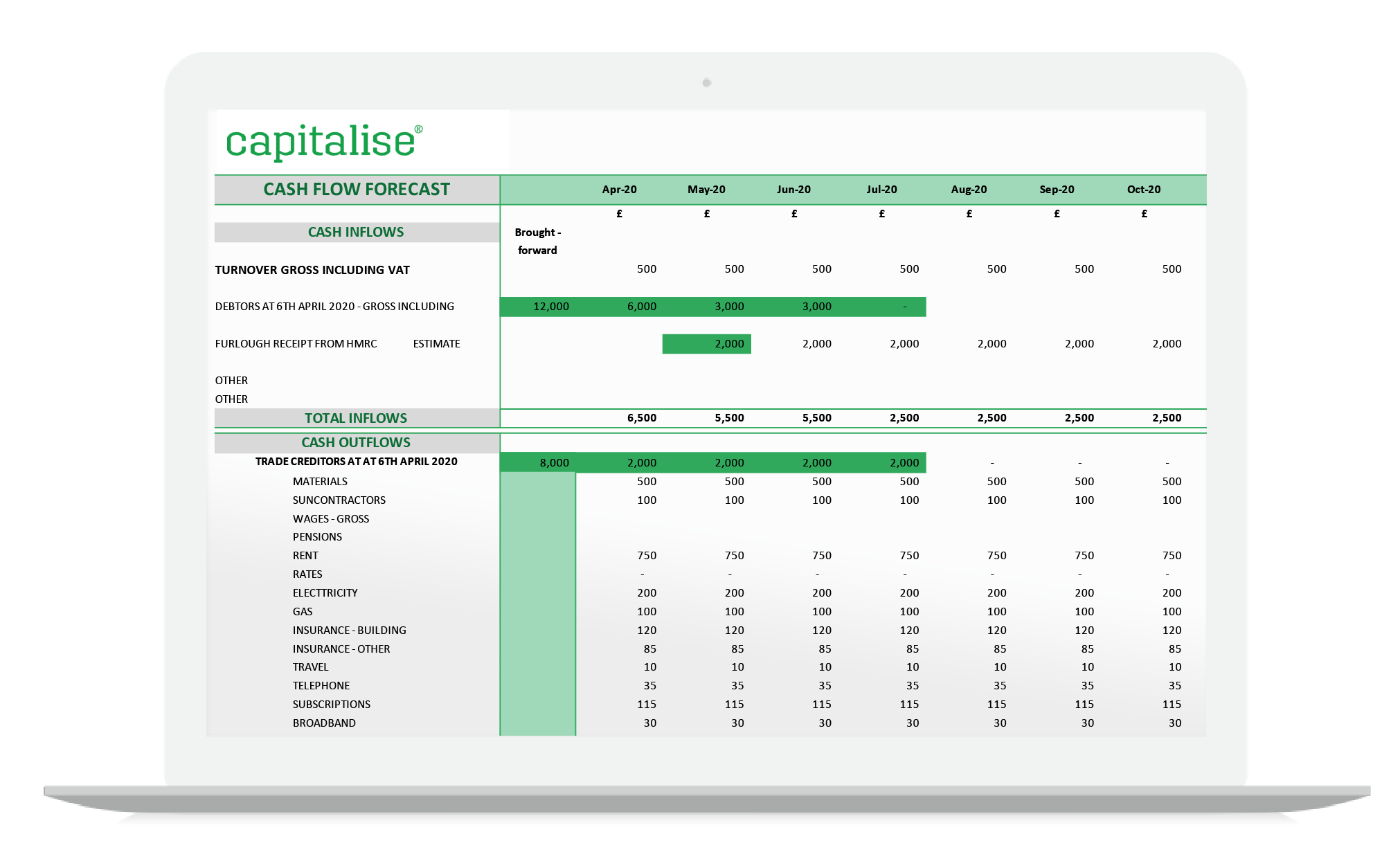

Lenders need to understand the purpose and amount of any requested facility and how these funds will be specifically used to address the shortfall caused by COVID-19. Use our cashflow forecast template to clearly show this funding requirement.

The information in this template allows lenders to work out the 'funding gap' of the business over the next 12 months.

For example if revenue is down to £0 and ongoing costs are £10k per month (once all government support is taken into account), then the funding gap will be £120k based on a 12 months forecast.

This will, likely, be the maximum a business can receive under CBILS.

Please note, some lenders use a 6 month forecast and others 12.

Capitalise has 33 of these 90+ lenders on our platform and our matching service will identify which products a business is eligible for. Don't hesitate to get in contact with us for more information on the CBILS process.

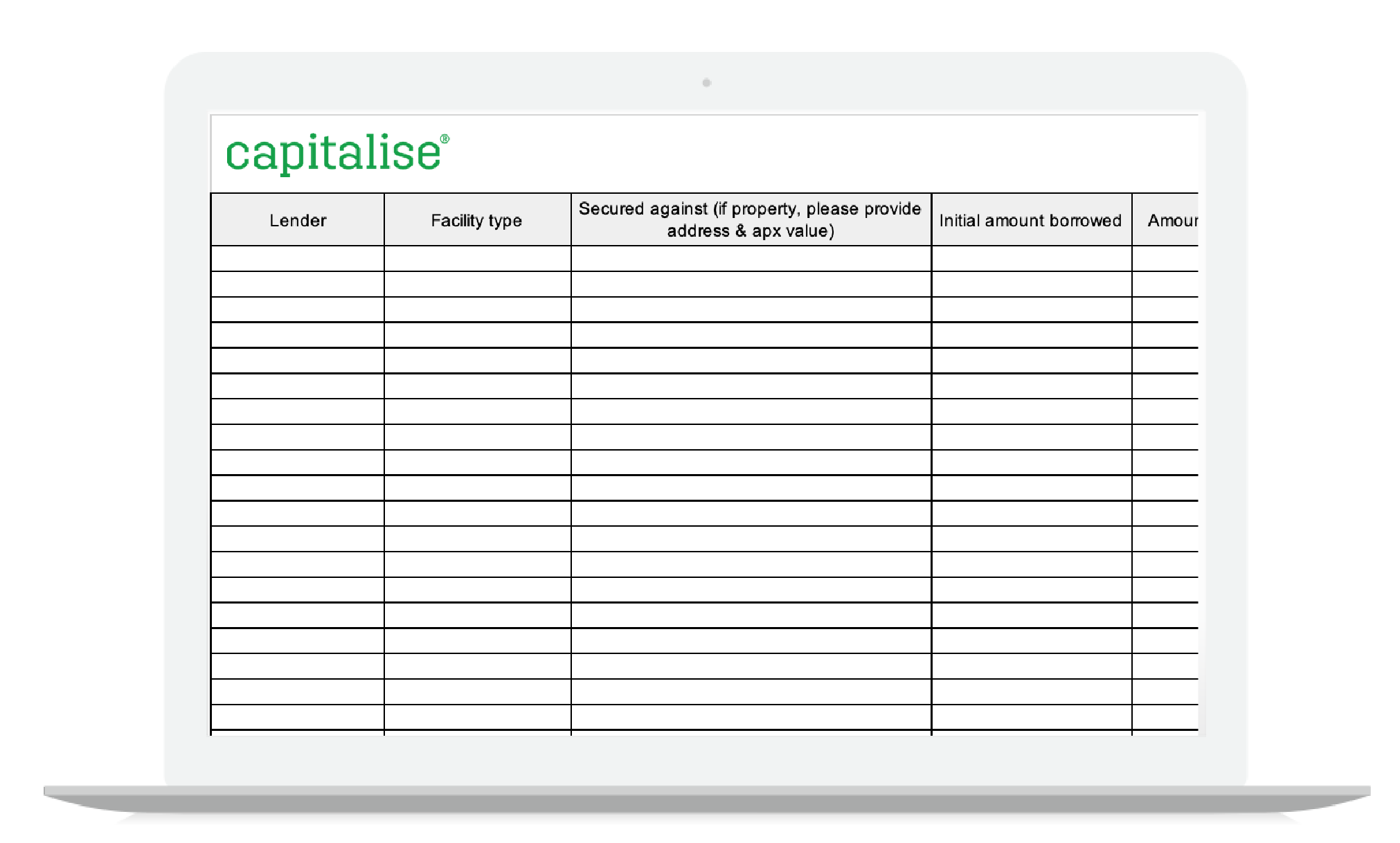

Current debt plays an important part in the decision to approve CBILS support. This template ensures all the relevant information about current debt is included.

Using this debt structure, lenders can easily work the serviceability of any new debt they need to take into account current debt repayments.

Capitalise has 33 of these 90+ lenders on our platform and our matching service will identify which products a business is eligible for. Don't hesitate to get in contact with us for more information on the CBILS process.