In 1779, a weaver named Ned Ludd broke two stocking frames in a fit of rage. Ludd’s act of destruction led to his name being co-opted by a protest group known as the Luddites.

Much like their namesake, Luddites were craftsmen. They feared machines would replace them and went on a spate of destruction, tearing apart the machinery they hated. As you’re probably well aware — I mean, just look around you — the Luddites didn’t succeed at halting modernity.

The spirit that animated the Luddites has never gone away, though. Distrust of the new, especially when it comes to the expansion of technology, is still common. Especially these days, with technology completely re-defining work, tasks and activities once thought of as ‘human’.

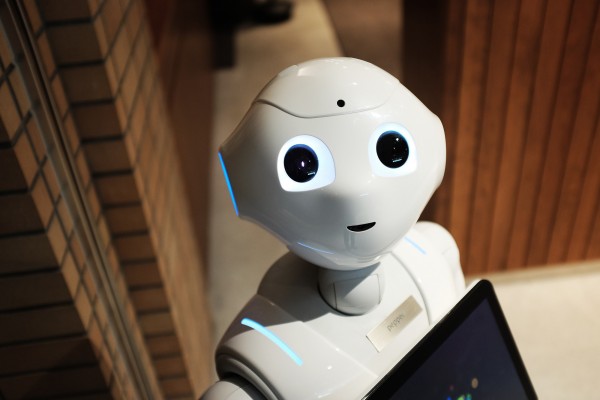

In fact, the dialectic of technological progress and reaction is stronger than ever. Take a look at Target, one of the biggest chain stores in the US. The megastore’s CEO has said it won't follow the trend for robot workers.

At Wal-Mart, Target’s big rival, autonomous robots roam the aisles at many of retailer’s stores, cleaning spills and scanning shelves for inventory shortages. Low-paid work traditionally done by humans.

"You won't see robots in Target stores anytime soon,” Target’s CEO said.