A Capitalise report into the role of the modern accountant, their evolving client relationships and the strategies they’re putting in place to build firms for the future.

How have your client relationships changed in recent years? We’d hazard a guess that they’re better than ever. And what has that meant for the part you play as an accountant? We’d be willing to bet that you’re enthusiastically stepping into the role of holistic business adviser.

No, we’re not mind readers. We’re making those predictions based on the research in our Firms of the Future report. We commissioned an independent research company to poll 500 UK-based accountants in April 2022 to gain insight into their relationships, people and numbers. The report delves into the role of the modern accountant, their evolving client relationships and the strategies they’re using to build firms for the future.

Download the full report right now or read on for a sneak preview of what we found out.

Relationships: building close connections

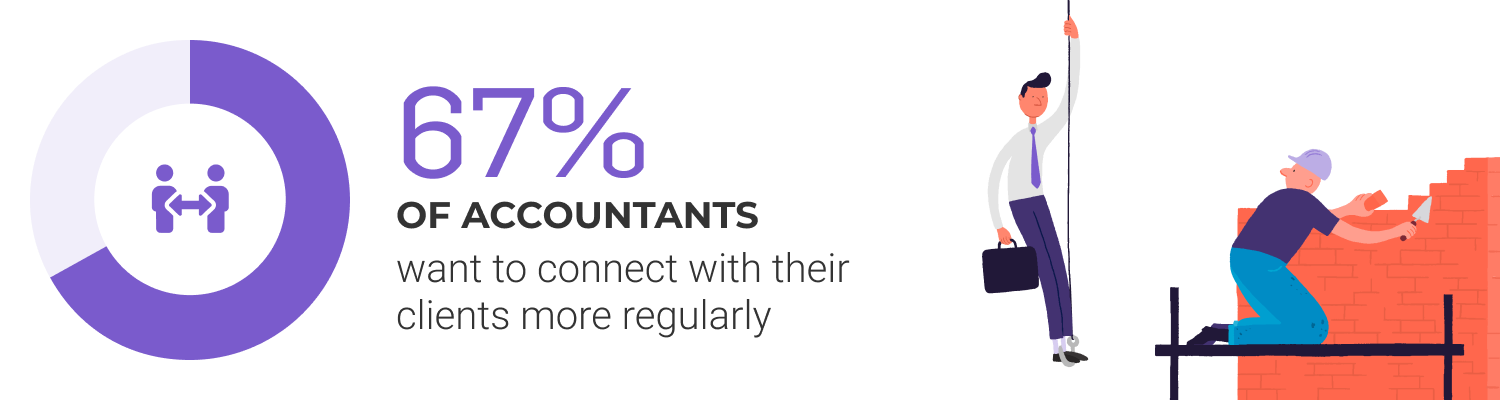

If our research has made anything clear, it’s that the bond between accountants and their small business clients has never been stronger. Relationships are much closer, conversations more meaningful and 67% of accountants want to connect with their clients more regularly.

Accountancy is no longer only about annual check-ins to go through receipts and file company accounts. More regular contact means a deeper understanding of each client’s day-to-day business operations as well as who they are as a person. There’s an exciting push and pull of accountants proactively offering comprehensive business advice and clients expecting their accountants to play a key and consistent part in their businesses.

Download our Firms of the Future report for a closer look at the relationship between accountants and clients, including the frequency and effectiveness of their interactions. We explore the way these bonds have evolved in recent years and what that shift means for both accountants and their small business clients.

People: standing out from the crowd

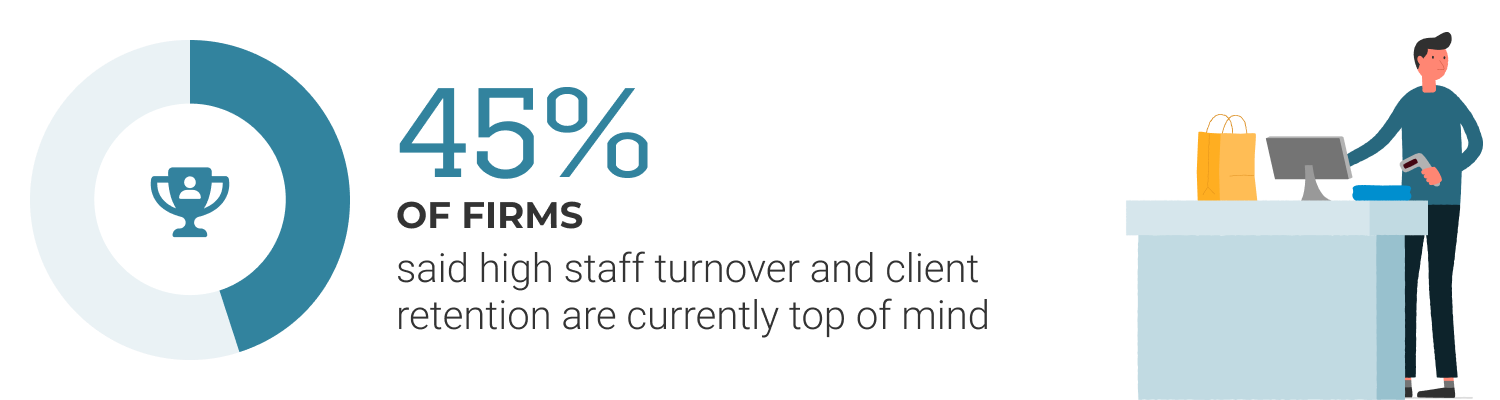

When we asked about their biggest challenges, 45% of firms said high staff turnover and client retention are currently top of mind. For many this will mean offering more services, to position themselves, not only as a preferred employer, but also as the preferred choice for their small business clients.

With the pandemic no longer leaning on the pause button, firms are once again planning for the future – with optimism and confidence. They’re asking: what's next? What will be our competitive advantage? How do we become a leading accountancy practice that's here to stay in the long-term?

Delve deeper into the frustrations accountants are dealing with and what excites them most about the next 12 months when you download the full report. We discuss the pressures of competing with the competition and the strategies that accountants are putting in place to stand out.

Numbers: making every minute count

The move into advisory is no longer an ‘if’ but a ‘when’ as accountants look to leverage the financial insights they’re gaining during their compliance work. For the many firms who have already made this transition, the conversation has turned to enriching and enhancing their existing advisory offering.

Because most small businesses operate without a Financial Director, they rely on their accountants to interpret potential risks on the horizon and to help them prepare. 58% of firms are getting proactive about credit improvement and funding, bringing these to the fore in their conversations with clients.

This section of our Firms of the Future report zooms in on the services accountants are offering, their perceived value and the pricing structure favoured by firms. Download your copy for all this, plus the advice they’re prioritising in the current climate.

Are you building a firm for the future?

Unlock even more of your firm’s advisory potential with Capitalise. Connect a complete range of business finance insights and solutions, all in one place, to expand your services in 2022. Advise and give your clients access to business performance insights, credit improvement, debt recovery and funding.