Value Added Tax (VAT) is an integral part of conducting business in the United Kingdom. However, for many businesses, the regular payment of VAT can place a strain on their cash flow, especially during times of growth or economic uncertainty. To alleviate this financial burden, VAT loans have emerged as a viable solution for UK businesses. In this blog, we will explore what VAT loans are, how they work, and the benefits they offer to businesses in the UK.

What is a VAT Loan?

VAT loans, also known as VAT funding or VAT finance, are financial products designed specifically to help businesses manage their VAT obligations. These loans enable businesses to bridge the gap between paying VAT to HM Revenue and Customs (HMRC) and receiving VAT refunds or sales payments from their customers. By providing access to the VAT funds before they are recovered, VAT loans offer businesses the much-needed liquidity to support their operations and growth.

How do VAT Loans Work?

VAT loans operate on a simple principle. When a business incurs VAT on its purchases, it pays the VAT to HMRC on a regular basis, typically quarterly or monthly. However, VAT loans allow businesses to access the VAT funds immediately after the VAT return is submitted to HMRC. Lenders provide loans equivalent to the VAT amount due, which the business can utilise for other purposes, such as paying suppliers, investing in new equipment, or covering operational costs. The loan is then repaid once the business receives the VAT refund or sales payments from its customers.

Advantages of a VAT Loan

- VAT loans provide businesses with a readily available source of funds, enabling them to optimise their cash flow. By accessing the VAT funds before they are recovered, businesses can effectively manage their working capital requirements and maintain steady operations without compromising on growth opportunities.

- VAT loans offer businesses the flexibility to allocate funds as per their specific needs. Whether it's investing in expansion, purchasing inventory, or managing unexpected expenses, businesses can utilise the loan amount to address their immediate financial requirements, helping them stay agile and responsive in a dynamic marketplace.

- With VAT loans, businesses can avoid the wait for HMRC to process VAT refunds, which can sometimes take weeks or even months. By accessing the funds upfront, businesses can expedite their financial processes, streamline operations, and reduce administrative burdens associated with VAT management.

- VAT loans eliminate the risk of late payment penalties that businesses may face if they struggle to pay their VAT obligations promptly. By ensuring timely VAT payments, businesses can maintain a good relationship with HMRC and avoid potential legal consequences.

Disadvantages of a VAT Loan

- VAT loans can be more expensive than other types of business loans as they are over a shorter term.

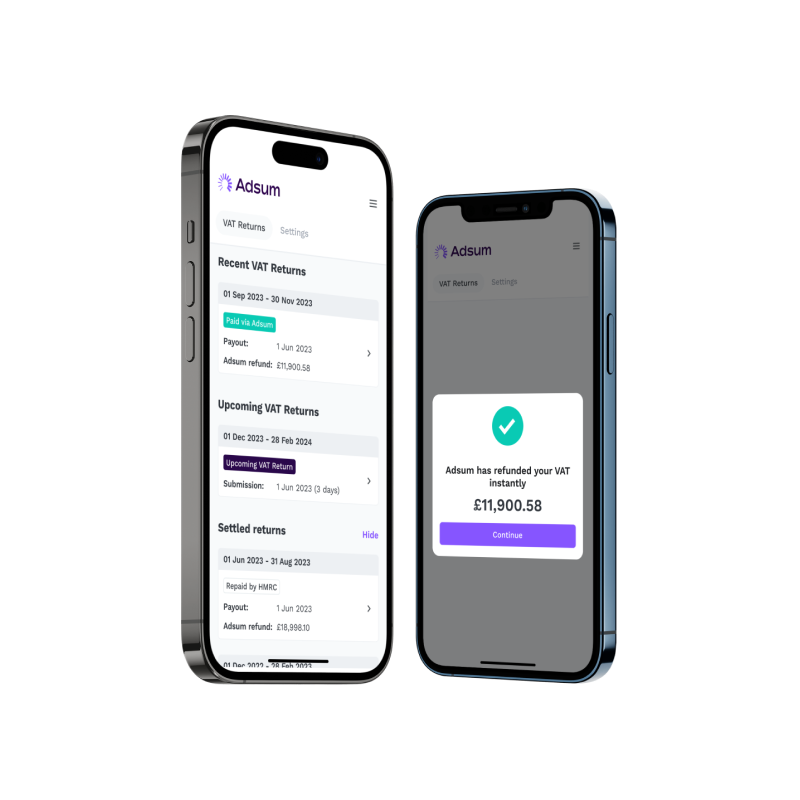

VAT refunds within 1 hour

Say goodbye to waiting days for your VAT refund.

Get your VAT refund within 60 mins, with our partner Adsum

Getting a VAT Loan

To be eligible for a VAT loan, you’ll need to have the following:

- VAT registered with HM Revenue and Customs (HMRC)

- 6+ months trading history

- Minimum £5,000 monthly turnover

- A good business credit score

Frequently asked questions about vat loans

If your VAT payment is more than 15 days overdue, your business will receive late payment penalties. The sooner you pay your VAT bill, the less late payment penalties will apply. You can find out more about late payment penalties.

As with any business loan, the amount you can borrow for a VAT loan will depend on a number of factors, including your business credit score and turnover.

Use our funding calculator to see how much you can borrow for a VAT loan.

VAT bills are usually paid every quarter of the year, so VAT loans tend to be short term 3-12 months. You could get a VAT loan every 3 months if your business is in good standing.

A VAT bridging loan can be used if a business needs to “bridge the gap” and cover the cost of their VAT bill if cashflow is tight. It is a fast and short term finance solution.

Login to your Capitalise account and tell us about your fudning requirements for a VAT loan. A funding specialist will give you 1-1 support and send your application up to 4 lenders that are most likely to approve your business. You could receive a VAT loan in as little as 48 hours.