Funding Invoice

Funding Invoice is a new, revolutionary peer to peer lending network which allows businesses of all sizes to quickly and easily access the capital needed to maintain cash flow and growth.

Since launching in October 2015, they have provided millions of pounds of invoice finance and working capital finance to innovative businesses up and down the country through their network of professional investors.

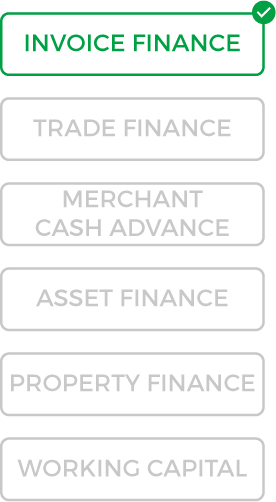

Funding Invoice products and sectors

Funding Invoice specialises in providing UK businesses with a range of invoice discounting, invoice factoring and working capital solutions, helping them to secure much needed capital without the stress usually associated with getting a traditional bank loan. With no lengthy contracts, minimum usage requirements, hidden fees or subscription payments, this flexible web-based service is suitable for a myriad of industries including property, retail, trade, manufacturing, automotive and haulage to name but a few. With invoice discounting, you'll be able to advance up to 90% of your outstanding invoices whilst retaining complete control over credit collections. Never again will you have to wait 90 days for an invoice to be settled, allowing you to focus on what matters most – the growth of your business. Funding Invoice also offers a selection of invoice factoring options which can take on many of the time consuming tasks associated with managing your credit control processes in-house.

Funding Invoice key benefits

Unlike fixed invoice discounting and invoice factoring contracts which work with your entire sales ledger, Funding Invoice allows you to select as many or as few invoices as you would like to draw from. Once your business has been approved, you'll be able to raise an invoice in the morning safe in the knowledge that up to 90% of its value will be available to you the very same evening.

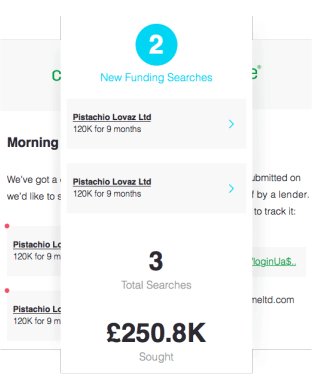

Compare Funding Invoice and other lenders instantly

Compare Funding Invoice with an ever growing selection of specially selected finance partners today at Capitalise.com. It takes just 3 minutes to complete your online profile and we'll then be able to match your business with a range of suitable lenders who not only offer fantastic funding solutions, but also bring a wealth of experience lending to businesses just like your