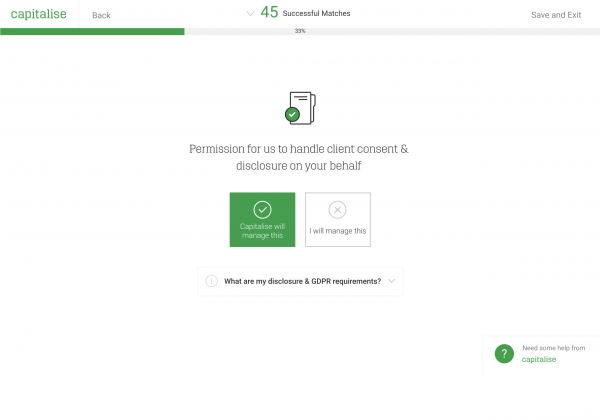

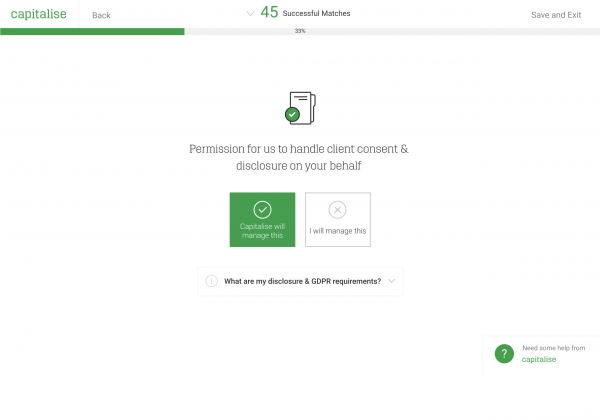

The new market for alternative lending has brought financing for SME’s into the modern era, but don’t let the speed and ease trick you about your legal obligations. Capitalise can help you manage your legal obligations by ensuring your client is made aware which lenders have received their data, as well as making clear how and when commission will be paid should they continue. You’ve almost certainly encountered a GDPR consent sign-off recently, but do you really know what you need to be disclosing to your client when helping them source finance?

Capitalise is ready and waiting to support you

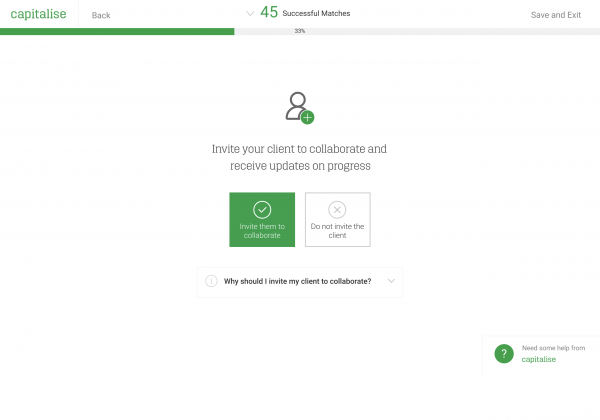

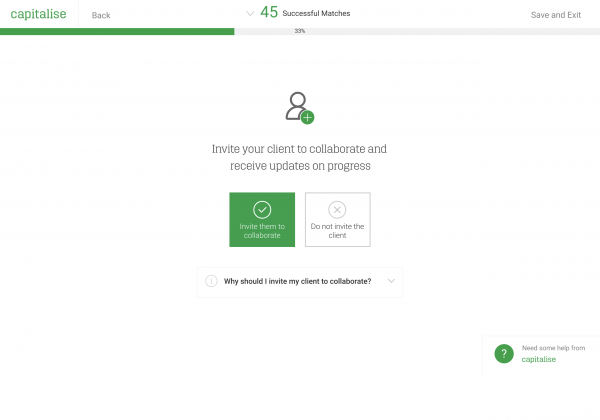

In a world where accountants are fast becoming the go-to advisers for SME businesses, ensuring that you control the interaction and process is important. At Capitalise we want to support you in growing your Capital Advisory services (these are services that help clients grow, recover and protect their capital) and we’re bringing you a new way to manage your client’s experience. As an added benefit, letting us help you manage the process improves the chances of getting an offer to over 90%!

Let Capitalise manage the process for a more successful search

Next time you're starting a funding search to help one of your clients we’ll present you with some new choices for how to manage their experience in the funding process.

Let us handle document collection

Capitalise can also help with the collection of mandatory documents required by lenders - let us save you the time and hassle of chasing your client for this, and we’ll ensure your funding search is ready to submit. You don’t have to give your clients access to Capitalise for this service, simply choose to ‘Let Capitalise manage’ consent and disclosure.

If you prefer to fully manage your client experience you can opt-out of this service. This means we won’t contact your client directly and you will be wholly responsible for ensuring they are aware of which lenders we’re sharing their data with, including making it clear that commission will be collected if they choose to proceed.

Decide if you’ll invite your client to collaborate

For more information about our latest features, speak to your partnership manager or support team.

Not yet a client? Find out more about Capital Advisory, funding, debt recovery and Capitalise, just book in a consultation with one of our team. There is a gift hamper in it for you.

- Book consultation