No matter how carefully you plan your business finances, an unforeseen cash flow issue can suddenly make it very difficult to stay on top of regular payments such as staff wages, tax bills and other company outgoings.

Unpaid invoices, delayed orders and unexpected bills can suddenly put the pressure on your working capital, particularly if you're an SME which doesn't yet have the cash reserves to see out a temporary dip in revenue.

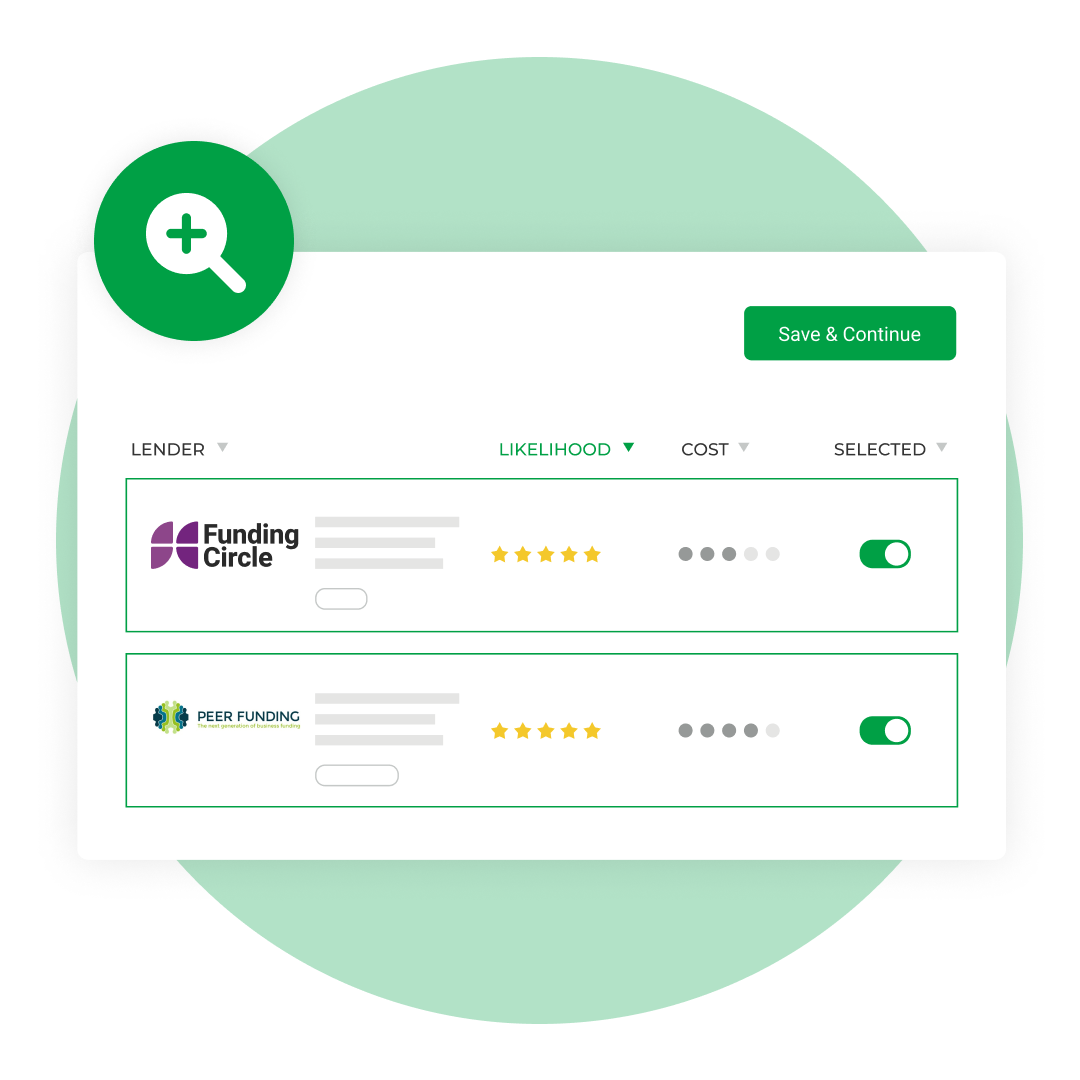

The good news is that there are plenty of finance solutions available to UK businesses. Capitalise brings together experienced, industry-specific lenders to help you plug the cash flow gap and keep on top of your daily outgoings.

Read on to learn more about what help is available when it comes to overcoming the cash flow challenges that business around the country face every day.