What business Financing Options Are Available?

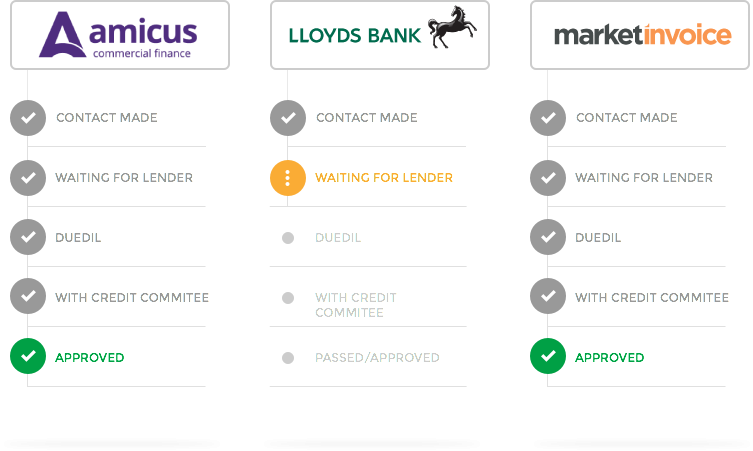

Below are just some of the UK business loans and other financing options available from our extensive panel of lenders.

-

Asset Finance | New asset and equipment purchases can be expensive business, particularly for SMEs looking to protect cash flow. At Capitalise, our lenders offer a wide range of hire purchase, contract and lease hire agreements to help avoid the large upfront costs often associated with these activities.

-

Invoice Finance | Waiting weeks or months for your raised invoices to be paid can detrimentally affect how your business moves forward, particularly during the early years of trading. With invoice factoring and invoice discounting, you'll be able to quickly and easily take an advance from these raised invoices with the added option of outsourcing the management of your sales ledger.

-

Merchant Cash Advance | If your business takes credit and debit card payments through an EPOS card machine then you may benefit from a merchant cash advance. A lump sum is paid directly to your UK business bank account and repaid in part each time you take a payment from a customer.

-

Trade Finance | Taking on larger customer orders is paramount to continued growth, but financing these larger orders can put a strain on finances. With trade finance, your lending partner will fund your supplier on your behalf with the amount borrowed only paid back once the finished goods have been purchased.

-

Working Capital Finance | These fast, flexible loans can be used to support your business in a variety of ways. From utility bills, rent and wages to tax bills, asset purchases and expansions, working capital finance can help to overcome the day to day financial challenges faced by your business.

-

Property Finance | From property redevelopment projects to large scale commercial builds, property finance can help your business to source the funds needed to take advantage of the latest opportunities within the property market.