When a lender is assessing your application, essentially they’re trying to determine whether or not your business would be able to pay back any money you borrow. In other words, how much of a risk is it to offer your business a loan?

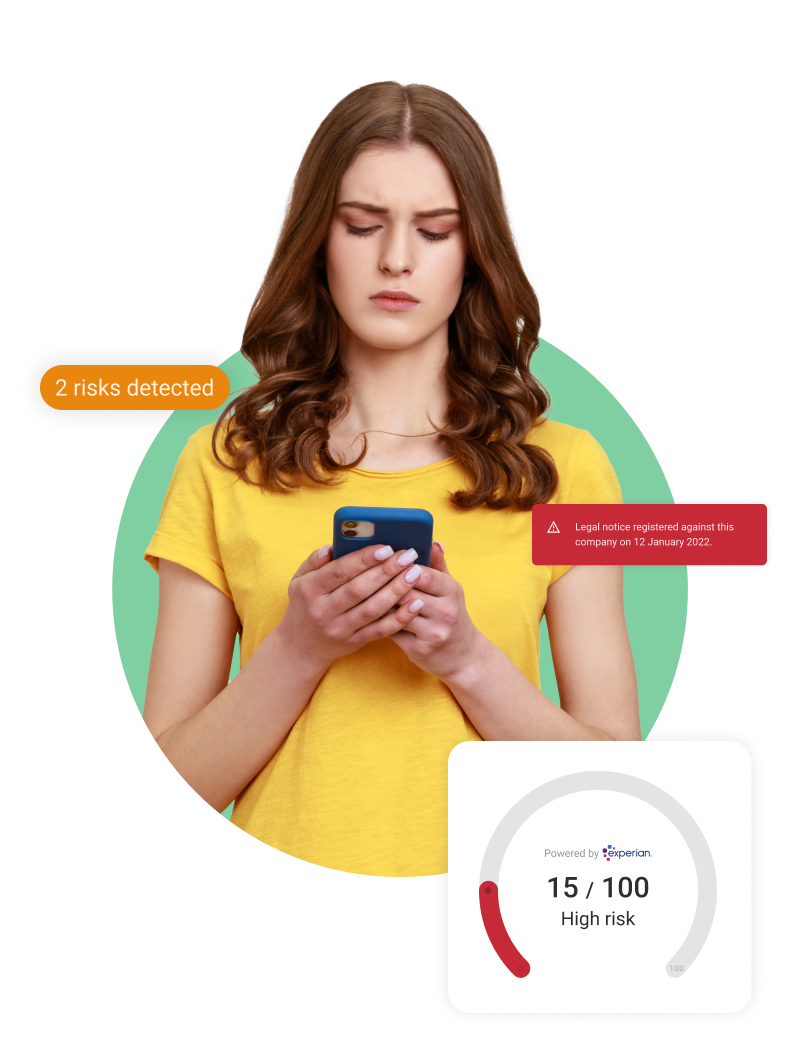

One of the key things that lenders look at to make their decision is your business credit score. The higher your score, the more likely it is that your business can keep up with the repayments on a loan. A lender will feel more comfortable offering your business a loan if they believe the risk of you not paying it back is relatively low.

Your business credit score is one part of a wider credit profile that lenders will take into account. Some of the factors they’ll be looking out for in your credit profile include your consistently filed annual accounts, good payment performance and no outstanding County Court Judgements.

Lenders will also look at the age of your business. A trading history of two years or more gives a lender a good sense of your ability to repay any money they lend to your business. They’ll also be interested in the sector your business operates in because some are considered lower risk than others.

When you apply for a business loan, a lender will want to know about any other debt or credit facilities that your business already has. That’s not to say that you can’t get a business loan if you already have another kind of funding. But a lender will consider whether or not your business can afford to take on more debt.

You can improve your chances of being approved for a business loan by taking the time to provide a well thought out application. A detailed business plan, for example, that clearly shows how you’ll use the loan can go a long way to strengthening your application. Especially if you have a young business with a shorter track record to rely on.

Applying for a business loan can feel overwhelming and you want to make sure that you get things right. It can be helpful to lean on your accountant to support you during the process, to answer questions and provide sound advice. Depending on the firm your business works with, your accountant may even be able to apply on your behalf. There’s no harm in asking!